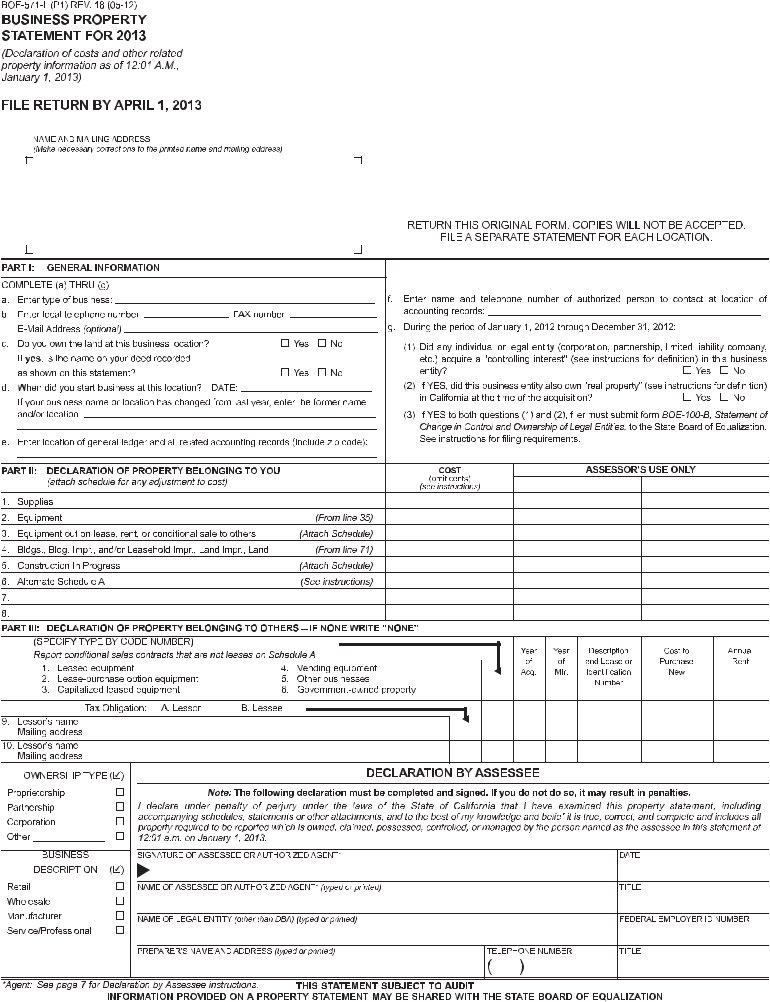

Ca Form 571 L - Per revenue and taxation code, section 441, you must file a statement if: B) you have taxable business property with a total cost of $100,000 or more, located in For a list of important deadlines go to related links below. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor requests the information. Statements are due april 1st. Statements are due april 1. Web businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal property is $100,000 or greater, or if the assessor requests the information in writing. Separate filings are required for each business location. Separate filings are required for each business location.

Statements are due april 1. B) you have taxable business property with a total cost of $100,000 or more, located in Statements are due april 1st. For a list of important deadlines go to related links below. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor requests the information. Per revenue and taxation code, section 441, you must file a statement if: Separate filings are required for each business location. Web businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal property is $100,000 or greater, or if the assessor requests the information in writing. Separate filings are required for each business location.