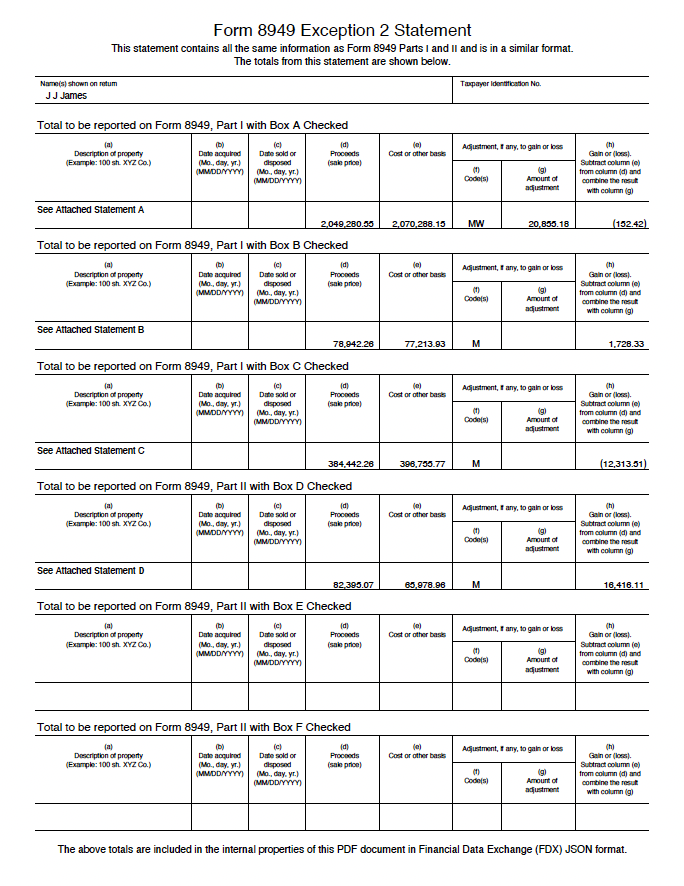

Form 8949 Exception Reporting Statement - Web you can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each. To report amounts directly on. If both exceptions apply, you can use both. Web there are 2 exceptions to filing form 8949. Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership. Web attaching a summary statement to schedule d/form 8949 in proconnect tax and resolving diagnostic. Web this article will help to report multiple disposition items without entering each one separately in the individual.

Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership. Web this article will help to report multiple disposition items without entering each one separately in the individual. Web attaching a summary statement to schedule d/form 8949 in proconnect tax and resolving diagnostic. If both exceptions apply, you can use both. Web there are 2 exceptions to filing form 8949. To report amounts directly on. Web you can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each.