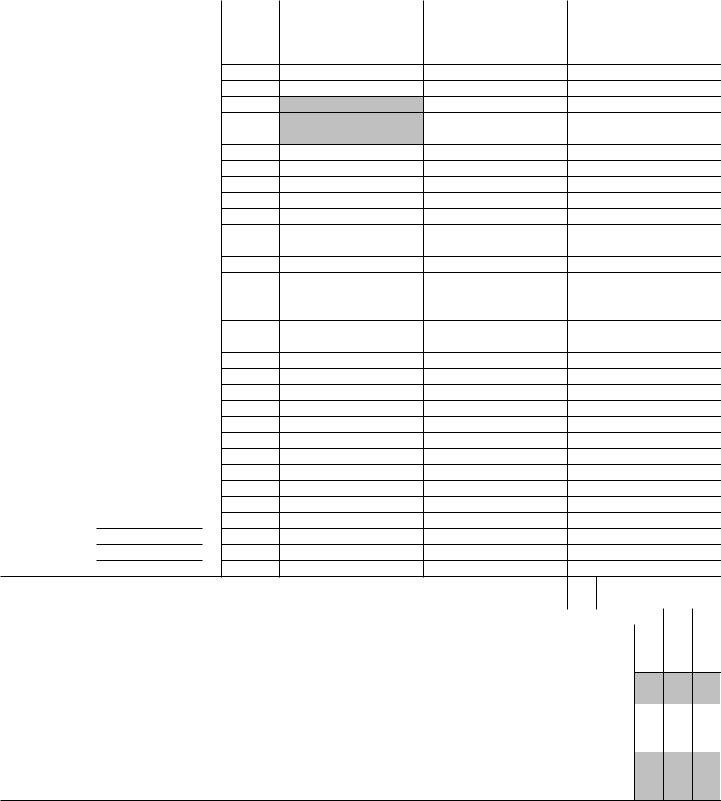

Form 990 Schedule M - Noncash items are reported on schedule m even if they are received and sold immediately. The schedule lists different types of categories to describe the donated property. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs. Web we last updated the noncash contributions in january 2024, so this is the latest version of 990 (schedule m), fully updated for tax year 2023. This information generally includes the quantity and the reported financial statement of the noncash contributions received by the type of property. You can print other federal tax forms here. Web schedule m is required to be completed if the organization has received noncash contributions, in the aggregate, greater than $25,000. Web schedule m is used by organizations filing form 990 to report the various types of noncash contributions received during the year and certain other information regarding those contributions received.

Web schedule m is required to be completed if the organization has received noncash contributions, in the aggregate, greater than $25,000. This information generally includes the quantity and the reported financial statement of the noncash contributions received by the type of property. Noncash items are reported on schedule m even if they are received and sold immediately. Web schedule m is used by organizations filing form 990 to report the various types of noncash contributions received during the year and certain other information regarding those contributions received. Web we last updated the noncash contributions in january 2024, so this is the latest version of 990 (schedule m), fully updated for tax year 2023. You can print other federal tax forms here. The schedule lists different types of categories to describe the donated property. Nonprofit organizations that file form 990 may be required to include schedule m to report additional information regarding the noncash contributions to the irs.