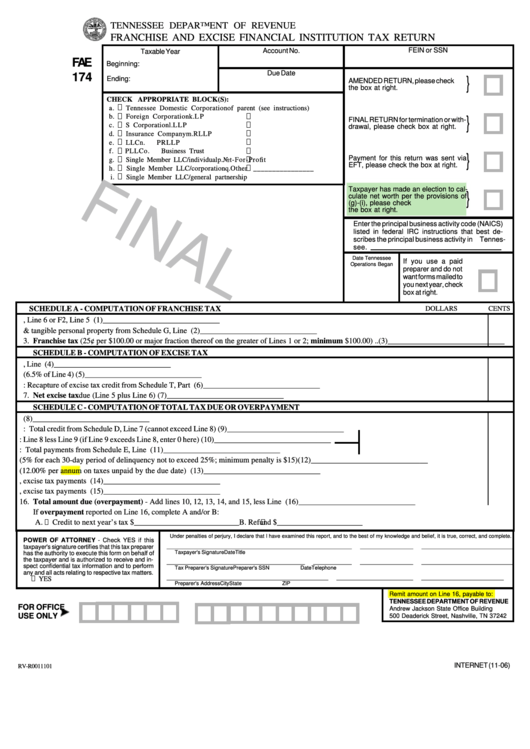

Tennessee Form Fae 170 - If your tax preparer has filed your return and you only need to make a payment, follow these steps. The kit does include financial institutions and captive reit. Form fae 170, franchise and excise tax return File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. To pay without logging into tntap: Web file a franchise and excise tax return (form fae170). Web using entries from the federal tax return and tennessee worksheets, the following forms are prepared for the tennessee return: For corporations, llcs & lps. Form fae 173, application for extension of time to file franchise, excise tax return; Schedules and instructions are included.

Navigate to the main tntap page; If your tax preparer has filed your return and you only need to make a payment, follow these steps. Form fae 173, application for extension of time to file franchise, excise tax return; File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Schedules and instructions are included. Form fae 172, quarterly franchise, excise tax declaration; For corporations, llcs & lps. To pay without logging into tntap: The kit does include financial institutions and captive reit. Web using entries from the federal tax return and tennessee worksheets, the following forms are prepared for the tennessee return: In the form (click on arrow to select from list) drop down input, select the form with the income applicable for this smllc. It's not supported for electronic filing when prepared in conjunction with federal forms 1040 and 1041. Form fae 170, franchise and excise tax return From the input return tab, go to state & local ⮕ taxes ⮕ tennessee smllc franchise, excise tax return. Web file a franchise and excise tax return (form fae170). File the annual exemption renewal (form fae183).